Pneumatic (air) fenders are the preferred choice for ship-to-ship transfers, offshore berthing, FPSO operations and ports handling large hull clearances- all activity areas that are growing in the Middle East. Global market reports show the marine fender market expanding steadily, with pneumatic fenders often the largest segment; country-level forecasts are rarer, but UAE demand follows global drivers (port expansions, offshore oil & gas activity, and logistics growth) led by operators such as DP World and Abu Dhabi Ports thereby proof that the UAE Marine Fender Market is on an upward trajectory owing to the expansion of the maritime industry in the region.

Pneumatic Fender Market size snapshot- what the numbers say.

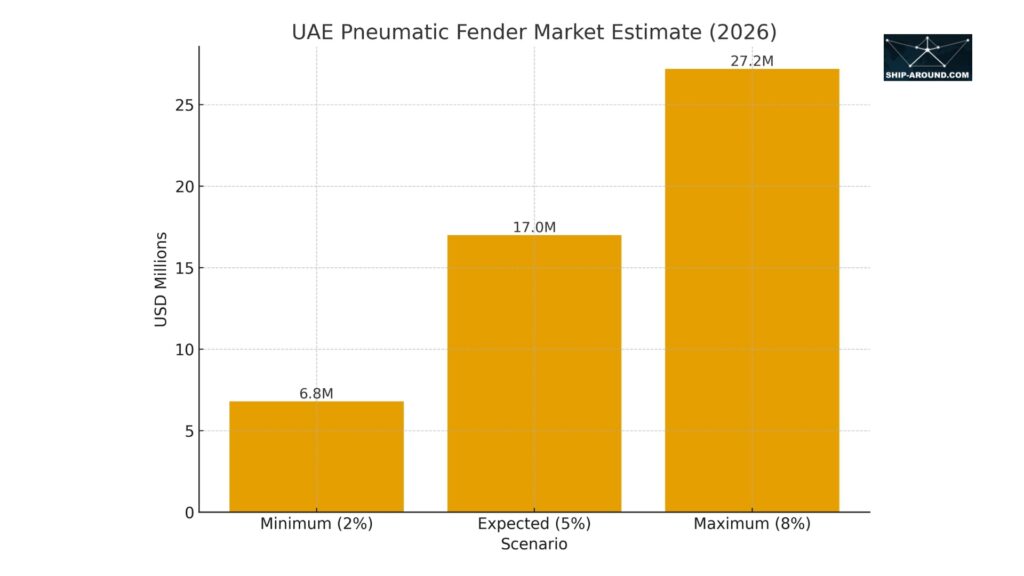

- Global context. Multiple market reports estimate the global marine-fender market in the $0.7–1.7 billion range in the mid-2020s, with pneumatic fenders representing a significant and growing share of that market. Reported CAGRs for the marine-fender space differ by source (typical ranges seen: ~3–6% for multi-year forecasts- market size and trends).

- UAE-level perspective. Dedicated UAE market studies are limited however, regional analysts (e.g., 6Wresearch) identify steady growth for the UAE marine-fender market through the late 2020s driven by port development, offshore infrastructure use, and increased ship-to-ship and bunkering operations. Because many public reports present global or regional numbers without a free UAE 2026 line item, any UAE 2026 estimate must be understood as an informed approximation that scales global/regional growth trends by local port and offshore project pipelines.

Using the conservative mid-range global CAGR figures (3–5% annually) and UAE infrastructure plans announced publicly (port expansions and offshore projects), the UAE pneumatic-fender demand in 2026 is best treated as growing modestly year-on-year rather than showing a sudden spike- exact dollar values will vary across paid report vendors (Verified Market Reports)

Why pneumatic fenders are important in the UAE:

- Offshore oil & gas operations. The UAE’s offshore platforms and FPSO / shuttle tanker activities require fenders with high energy absorption and large clearances; pneumatic fenders provide low reaction force and wide clearance, making them ideal for such use cases.

- Ship-to-ship (STS) transfer and bunkering. The UAE is a major bunkering and STS hub: pneumatic fenders’ conformability and buoyancy make them preferred for safe STS transfers.

- Port expansions and mega-projects. New berths, container throughput growth and offshore service bases (e.g. new terminals and logistics facilities) sustain recurring demand for fender replacement and new installations.

Pneumatic Fender leading brands (global → UAE presence).

These are the brands sourced most often in manufacturer listings, operational preferences and our regional supply:

- Trelleborg / Trelleborg Marine Systems: A global OEM for pneumatic fenders and smart-fender monitoring, Trelleborg emphasizes ISO compliance and product lifecycle services. Trelleborg products are specified in large port and offshore projects worldwide.

- Yokohama / Yokohama-type manufacturers (multiple licensees): The “Yokohama-type” pneumatic fender is a widely used design; many specialist vendors produce variants (with/without tyre net). Our product pages and regional distribution describes typical configurations for UAE/global use.

- Regional suppliers & distributors (UAE digital marketplaces): Ship-Around list Trelleborg, Yokohama-Fenders, IRM Fenders and other OEMS/specialists listings with local distribution that provide supply, installation and spares in the UAE and on a global scale. Our streamlined network and local agents are important for lead times and after-sales support in the region.

Market leaders and procurement buyers in the UAE.

- Port operators, Bunkering, Shipyards, STS operators, marine contractors, naval logistics providers and terminal owners.

- Offshore oil & gas operators and service companies.

Practical guidance for procurement teams:

- Specify by application. Use low reaction force and large clearance specs for FPSO/STS; foam/solid fenders for fixed berths may be appropriate in other contexts. Reference ISO-17357 where project risk is high.

- Require lifecycle costing. Evaluate total cost of ownership: installation, inspection intervals, repairs and availability of spares. Our local distributors are valuable for fast spares supply.

- Insist on verification. For major projects, request third-party load/energy absorption data and compliance certificates. Consider fenders with monitoring options for critical berths.

- Build vendor redundancy. Where operational continuity matters (bunkering hubs, FPSO operations), pre-qualify reputable suppliers to avoid single-source risks.

Outlook to 2033- what to expect from the Pneumatic Fender market.

- Moderate, steady growth. Global report averages point to a single-digit CAGR for marine fenders through the early-to-mid-2030s; pneumatic fenders are likely to capture a major share of growth for offshore and STS markets. UAE demand should track port and offshore project pipelines, producing steady procurement needs (replacement cycles and new berth installs) rather than sudden spikes.

- Higher technical specification trend. Expect more projects to require ISO compliance, IoT monitoring (smart fenders) and environmentally conscious materials or handling procedures. Manufacturers with local service networks will be advantaged.

UAE’s importance in regional port operations (DP World, AD Ports, Port of Fujairah) and significant bunkering/STS activity justifies a higher per-capita fender demand than a small port state but lower than large shipbuilding/repair hubs.

Join hundreds of EPCs, Port operators and Shipyards, STS operators, terminal owners and procurement professionals who trust Ship-Around to deliver efficiency, reliability, and innovation across the LNG value chain. Explore our LNG solutions today at www.ship-around.com or contact our team to discuss your project requirements.